Recent Articles

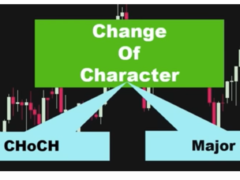

BEST PRICE ACTION TRADING STRATEGY

By identifying trends or “signals” in the price movements of an underlying market, price action trading is a strategy that helps in market anticipation. Here are some additional price action ideas to learn about. What is price action in trading? In trading, price action examines the past behavior of a security, index, commodity, or currency […]

SMC STRATEGY FOR BEGINNERS

What is SMC Strategy? The SMC strategy is a simple, conventional trading method that accurately analyzes entry and exit trade positions by utilizing fundamental ideas such as supply and demand, price action trading strategies, and support and resistance tactics. In this procedure, traders analyze the market structure while paying more attention to the movements of […]

HOW DOES FOREX TRADING WORKS

What is Forex Trading? Forex trading, often known as FX trading, is similar to exchanging money when traveling abroad. You sell one currency and purchase another. But you’re trying to make some money instead of doing it for need. as you purchase or sell these currencies using the appropriate tactics, you could profit as their […]

NEW: CHANGE YOUR LIFE WITH FOREX TRADING_2024

How Forex Trading can Change Your Life Try to picture yourself at the age of 60 years, what opportunities would you be thinking or wish you would have take?. There are a lot of opportunities that would have change your life and that does not mean you can take every opportunity that comes on your […]

Why Is Purchasing a Home Insurance Policy Important for You?

Your financial expenses, if a fire, theft, natural disaster, or other unanticipated catastrophe damages your home, are covered by home insurance or homeowner insurance policies. Home insurance coverage also protects your house and its belongings from potential future losses. It makes sense to have your home insured because the initial investment in a property is far bigger than that of other types of assets. Additionally, having a house insurance policy is advised in a nation like India that is vulnerable to natural disasters like floods and frequent fires. These are some more justifications for getting house insurance. If an incident occurs, whether unintentional or natural, a home insurance policy provides sufficient coverage for the house and its belongings. • Tenants can get the policy and keep their home’s goods safe; it is not just for homeowners and landlords. • You can choose to secure your house, its belongings, or both with a home insurance policy. • You can use the Agreed Value Basis to lock in your apartment or flat. Coverage 1. CREATING CONNECTED MEDIA • EmergenciesYou are entitled to reimbursement for costs incurred if the building or dwelling sustains damage, including emergency purchases of food, clothing, and other necessities. • ConstructionIf there is a loss or damage to the apartment or building, the insurer will compensate the insured. All broken or pilfered items in the house are replaced and repaired by home insurance. If an unfortunate incident renders your home unusable, home insurance will pay for your temporary living expenses, such as rent or hotel stays, while you rebuild or repair your house. With HDFC ERGO home insurance, you may make use of this service with alternate accommodation coverage. • Paintings, artwork, etc. After the value is established by an evaluator selected by the insurance or one approved by the government, the insurer will indemnify you for artwork, paintings, etc. 2. HOME COVERAGE CONTENT: • Content loss or damageThe policyholder will get compensation from the insurer based on the items that were insured when the policy was purchased. • Valuables or jewelryAs long as the policyholder’s possessions are located in India, the insurance will pay out for lost jewels and other items. You could expand it to global coverage with a little more money. 3. PROTECTION AGAINST LIABILITIES: Liabilities resulting from your property are also covered by home insurance. For instance, damage to your neighbor’s house from a fire that spread from your own, or an accident in which one of your family members or a third party was hurt. It shields your home and you from all potential legal issues. 4. PROTECTS FROM MAN-MADE AND NATURAL DISASTERS: Your house is protected by your home insurance from damages brought on by man-made risks like theft, rioting, vandalism, and natural disasters like fires, lightning, floods, and earthquakes. 5. RENT DECLAREDY may rent out your residential property if it becomes uninhabitable. If you choose to have a loss of rent coverage under HDFC ERGO house insurance, the insurer […]

What Are California’s Minimum Requirements for Car Insurance?

Every registered driver in California needs to have a minimum amount of California car insurance. If you are found to be driving without the required minimum amount of insurance, you may be penalized. In the state of California, car insurance is crucial. If you cause an accident without insurance and cause harm to others, you may be held legally responsible for the damages. Hundreds of thousands of dollars could be involved. In addition, you might not be able to get reimbursement for your losses if you are hurt in an accident and you do not have car insurance. However, the minimum standards vary by state. Only California’s minimum car insurance regulations will be covered in this article. Minimum Requirements for California Car Insurance Before getting behind the wheel in California, all licensed drivers must have car insurance or demonstrate some other type of financial stability. […]

What Distinguishes Medical Insurance From Health Insurance?

Health insurance and medical insurance are two products that frequently generate confusion when it comes to health. There are several definitions for the phrases “mediclaim” and “health insurance plan.” What Is Health Insurance? Health insurance covers the insured’s out-of-pocket costs for procedures and medical care. The insured is responsible for covering these costs out of pocket, waiting for the insurer to reimburse them, or having the insurance company pay the hospital directly. The terms and conditions of the insurance policy apply to the benefits and features. In most cases, the coverage is extensive, and the cost is frequently more than that of a Mediclaim Policy. What Is Medical Insurance? A specific type of insurance that offers financial protection against medical expenditures is referred to as “medical insurance.” It’s an affordable method for handling any medical concern. Nevertheless, the insured bears the entire expense of any subsequent care; the coverage is limited to hospitalization. Types of Health vs. Medical Insurance Different health and medical insurance plans are available to meet the needs of various individuals. The offers vary based on your desired level of investment and your budget. Health Insurance Type The many types of health insurance that are offered in India are as follows: Individual Health Insurance Plan: This type of insurance is specifically designed for a single person, as the name suggests. This plan will provide financial support in the event of an emergency medical situation. Every member of your family needs to have their own policy, with a separate sum guaranteed amount for each covered individual. Family Floater Health Insurance Plan: This insurance plan is designed for a single person, as the name suggests. This plan will provide financial support in the event of an emergency medical situation. Every member of your family needs to have their policy, with a separate sum guaranteed amount for each covered individual. A sort of medical insurance plan for a group of workers at the same company is called a group health insurance plan. This plan is frequently chosen by a company, business organization, or startup to meet the health insurance needs of its staff members. It is also among the most important perks that an employer may offer staff members. The Critical Illness Insurance Plan offers financial assistance if the policyholder is identified as having a catastrophic illness or disease. Paralysis, heart attack, stroke, kidney failure, and many other illnesses are covered. If you are diagnosed with any of the above disorders, the Critical Illness Policy offers a financial safety net because treating these conditions is quite expensive. Personal Accident Insurance Plan: Mishaps can occur at any time, and medical expenses for treating injuries can quickly deplete your funds. Accident-related medical costs are covered by a personal accident insurance policy. The policy provides coverage for death from an accident, permanent disability, and partial disability. Maternity Health Insurance Plan: Maternity Health Insurance Coverage is an add-on to a standard health insurance policy. All costs related to the pregnancy, delivery, and the postpartum phase are paid for. The waiting period for this plan varies depending on the insurer. This plan should therefore be put into action as soon as possible. Senior Citizen Health Insurance Plan: This type of insurance coverage is tailored to the needs of individuals over 60. The premium for this plan is higher because seniors require more medical care and are more likely to file a claim. The insurance coverage includes medical care and other costs, pre- and post-hospitalization charges, and pre-existing condition coverage, though the extent of coverage is limited by the terms and conditions of the policy.

Medical Insurance

Medical Insurance Our product selection is as follows, and it is available at various insurance cover levels. We provide medical insurance policies that vary from extremely basic to high-end executive worldwide. Customized Plans Customers may have a subconscious need for unusual products. Large groups can benefit from strategists’ ability to create individual plans that are tailored to each customer’s specific needs. Plans for Group Health Insurance Health plans with group insurance cover a group of people, typically workers of the firm or members of the organization. Members of group health insurance typically pay less for their coverage because the insurer shares the risk with a larger number of customers. There are two types of group medical insurance: standard off-the-shelf plans and custom plans. What Our Group Health Insurance Plans Offers: Impatient Benefit Outpatient Benefit Maternity cover Chronic Diseases cover Dental and optical Foreign Treatment International Emergency […]

Moms and newborns can get health insurance with Vodacom.

health insurance with Vodacom Tanzania has given 600 mothers and babies at the Mwananyamala, Amana, and Temeke regional referral hospitals in Dar es Salaam a full year of comprehensive health insurance coverage. Just a few days after President Samia Suluhu Hassan signed the Universal Health Insurance bill into law, which will make it easier for Tanzanians of all economic backgrounds to access healthcare services, Chief Medical Officer of Mwananyamala Regional Referral Hospital Dr. Zavery Benela stated over the weekend that the donation comes at the perfect time. “Mothers’ and newborns’ health is impacted by this donation,” he stated. health insurance with Vodacom claims that the insurance coverage given to expectant mothers and babies is a component of the company’s ongoing holiday promotion, “Sambaza Shangwe, Gusa […]

Everything you should know about filing an insurance claim for a stolen vehicle

Everybody presumably dreams of owning a car, but achieving this goal entails taking on the additional duty of having auto insurance claim to support you in an emergency. Getting insurance coverage for your car is seen as nothing less than a duty, mostly to cover liabilities or third-party damages in the event of an accident. Although the value of having auto insurance has been discussed extensively, many of us do not benefit from these policies. When it comes to Indian data, the number of stolen cars is rising annually. On the list of states with the […]