faith

faith's Latest Posts

Health Insurance: What Is It?

Health Insurance: What Is It? A corporation and a customer enter into a contract for health insurance. In exchange for a monthly premium, the insurance company promises to cover all or part of the insured person’s medical expenses. Typically, the contract lasts for a year, during which you will be liable for covering certain costs associated with illness, injury, pregnancy, or preventative care. In the United States, health insurance policies typically have the following exclusions from coverage: A deductible that, prior to the start of the company’s coverage, forces the customer to pay a portion of their medical expenses “out-of-pocket” up to a particular amount or more co-payments, which impose a fixed financial burden on the client for particular treatments or operations How Medical Insurance Operates It might be challenging to understand health insurance in the US. There are several regional and national rivals in this industry, and their offerings, coverage, and costs differ from one state to the next and even from county to county. The majority of Americans have access to health insurance as a benefit of their jobs, with their employers paying a portion of the costs. With some exclusions for employees of S corporations, the employer’s expenditure is tax deductible, while the employee’s benefits are tax-free. Individuals who work for themselves, freelancers, and gig workers have the option to purchase insurance directly. The Affordable Care Act of 2010, also referred to as Obamacare required the establishment of HealthCare.gov, a nationwide database that enables people to look for standard plans offered by commercial insurers in their area. For taxpayers whose income falls between 100% and 400% of the federal poverty threshold, the cost of the coverage is subsidized. Health Insurance Types Navigating health insurance can be challenging. Policyholders of managed care insurance plans in the United States are required to receive their medical care from a network of pre-approved healthcare providers. Patients are required to pay a larger portion of the bill if they seek care outside of the network. Payment for services received outside of the network may even be explicitly refused by the insurer. Patients are required to select a primary care physician as part of many managed care plans, such as point-of-service plans (POS) and health maintenance organizations (HMOs), who oversee the patient’s care, provide treatment recommendations, and refer patients to medical specialists. PPOs, or preferred-provider organizations, charge less for using in-network practitioners and services but do not require referrals. If specific services are obtained without prior authorization, insurance companies have the right to refuse coverage. If a comparable medication or a generic version is cheaper, they could refuse to pay for name-brand medications. Examine the policies of an insurance provider before purchasing their coverage. Health Plans with High Deductibles (HDHP) The high-deductible health plan is one kind of health insurance that is becoming more and more popular (HDHP). These plans offer cheaper monthly premiums along with bigger deductibles. The only people who can start a Health Savings Account (HSA) with significant federal tax benefits are their users. A health plan with deductibles of at least $1,600 for an individual or $3,100 for a family in 2024 is considered high-deductible. Maximum total out-of-pocket amounts are $16,100 for a family and $8,050 for an individual.9. One special benefit of high deductible health plans is that, if you have one, you can form a health savings account and deposit pretax money into it. This account can then be used to cover eligible medical costs. […]

How a life insurance policy might be used to borrow money

For many customers, purchasing permanent life insurance is an appealing alternative. It not only offers lifetime coverage, but it also accrues monetary worth that you can use down the road. Additionally, you have the option to borrow against your life insurance coverage. As an emergency reserve you hope you’ll never need, a life insurance loan can help you receive cash when you need it. Although it’s frequently simpler and less expensive than taking out a conventional bank loan, borrowing against your life insurance policy carries some risk. Determining if a life insurance loan is the appropriate form of finance for you requires knowledge of your options as well as the advantages and disadvantages of the product. Life insurance policies that you can borrow against Term life insurance and permanent life insurance are the two main categories of life insurance. Term life insurance provides a guaranteed death benefit and a level premium for a predetermined amount of time, or term, such as ten or twenty years. It has no monetary component and cannot be used as collateral for a loan. You have both a death benefit and a cash value if you have permanent life insurance. Over time, the monetary value increases with interest. Your permanent life insurance policy’s cash worth acts as collateral when you take out a loan against it. The following categories of permanent life insurance contracts are available for borrowing: Whole life insurance. Universal life insurance. Variable life insurance. The operation of a life insurance loan It’s not too difficult to borrow against your life insurance coverage. Usually, all you have to do is give your insurance provider a call and ask for the loan. In some circumstances, you might be able to finish the procedure online. John Graves, the managing partner and founder of G&H Financial Group, states that there are no limitations on the usage of funds or lending conditions. Additionally, purchasing a life insurance policy will frequently result in lower interest rates than purchasing a bank loan. Additionally, the cash amount of your life insurance policy determines your loan eligibility rather than your creditworthiness, making the money more easily available, especially if your credit history has been patchy. You can usually pay yourself interest on a loan taken out against your policy, but your insurer can impose a fee called a spread. The amount you will be charged for a loan is determined by your insurance. A spread can be as low as 0%, although it usually ranges […]

Family life insurance: what is it?

Family life insurance The term “family life insurance” refers to a broad category of life insurance plans that can provide coverage for your whole family. It does not, as the name would imply, describe a particular insurance product. Insurance firms don’t just sell family life insurance as a single package. It might sometimes refer to the option to buy extra coverage for family members. For others, it’s a means of saying they have something to offer each member of the family. How does a family life policy function? There are numerous ways to get family life insurance. Certain insurance providers provide family life insurance, which is essentially a collection of policies meant to protect every member of your family. Large-term or whole life insurance policies for parents may be part of that product suite, along with lesser policies intended to solely pay for other family members’ funeral costs. In other situations, riders on a primary policy are used to generate family life insurance. You can add life insurance for your spouse to your current term or whole life insurance policy with the help of a term rider that certain insurers offer. Many also provide a children’s term rider, which gives your kids a little coverage that frequently ends when they turn a specific age. What advantage does obtaining these riders have over just getting individual coverage for each member of your family? Depending on the circumstances, you might be able to add your husband and kids without having to worry about additional underwriting. Furthermore, these riders may eventually be converted into independent policies by certain insurers. Family life insurance types Term life insurance The most popular kind is term life insurance. It offers coverage at a locked-in premium for a predetermined amount of time, such as 10, 20, or 30 years. Your beneficiaries will get the life insurance payout, or death benefit if you have a term life insurance policy and pass away within the policy’s term. The majority of the time, you can prolong coverage by renewing the insurance, but the cost will increase. The most economical type of life insurance is usually term life insurance, and the younger you are, the less expensive the coverage will be. It is therefore a well-liked option for young families on a tight budget. Children’s riders, or policy add-ons, are another popular feature of life insurance companies that let you personalize your coverage to include your kids. enduring life protection As long as you keep paying the premiums, permanent life insurance remains in effect for the rest of your days. A cash value component is included with permanent life insurance, in addition to a death payment for your beneficiaries. You can access the cash worth of the account, which may increase in value over time, as long as you live. A percentage of your premiums are placed in it. Whole life, universal life, and variable life insurance are among the various varieties of permanent life insurance. How your cash value increases will depend on the kind of policy you select. Depending on the investment you select, you may occasionally lose money, but certain policies ensure growth. Because permanent life insurance plans never expire, they can be a desirable option. They can also be used as a vehicle for investments, but if you have a specific objective in mind, it could be a good idea to look into other kinds of investment accounts and consult with a financial counselor who can help you determine which is the best. Many families decide to buy permanent life insurance for each member of the family, so creating what amounts to a family life insurance plan. One advantage of this approach is that whole life insurance, like term life insurance, lets you fix the premiums for your policy. Thus, if you get a whole life policy for your young child, it will come with a very cheap premium that they can use for the rest of their lives. Having said that, the whole life insurance policy you buy for your kid is probably going to have a lesser death benefit than most other options and a lower rate of return on investment. Riders on life […]

Voluntary life insurance: what is it?

Voluntary life insurance You can get optional life insurance through your workplace at a discounted rate if you choose to acquire voluntary life insurance. Typically, you have a choice between voluntary permanent life insurance and optional term life insurance. You can lose your voluntary life insurance if you quit your job. As part of their benefits package, many businesses carry life insurance, but the coverage is usually insufficient to meet the needs of your dependents, such as your spouse, kids, or other family members.You can occasionally add to the coverage your company offers by choosing to buy an optional life insurance policy. Although doing so can offer a straightforward route to more thorough coverage, is it the greatest choice?We’ll assist you in determining which life insurance plan best suits your needs, when you might want to take advantage of voluntary life insurance, and how to navigate your options. The fundamentals of optional life insurance You can get optional life insurance through your workplace at a discounted rate if you choose to acquire voluntary life insurance. Although you will be responsible for paying the premium yourself, it will probably be less expensive than buying coverage separately because it will be taken out of your salary. Term or permanent coverage are usually options when buying a voluntary life insurance policy. Additionally, you might be able to choose to voluntarily add accidental death and dismemberment (AD&D) insurance. Term life insurance Term life insurance offers coverage for a predetermined period of years, usually between 10 and 30, at a fixed rate. Usually, coverage stops when the policy term ends , and your beneficiaries will no longer be eligible to receive a death benefit in the event of yor passing. Selecting the appropriate term length at the outset is crucial since, while you might be able to renew the insurance, doing so usually comes with a greater cost. If you want coverage for a specific amount of time, such as until your children graduate from school or your mortgage is paid off, term life insurance is the ideal option. Its lack of a cash value component makes it less expensive than whole life insurance. Permanent life insurance Whole life and universal life insurance are examples of permanent life insurance. It usually contains a cash value component and lasts for the entirety of your life. Although it may take a few years for adequate value to build up, you can borrow against or withdraw from the cash value as it increases over time. Permanent life insurance is more expensive than term insurance because it lasts for your entire lifetime and contains cash value. What is the cost of optional life insurance? Many businesses provide a set level of coverage at no cost to the worker; this amount is frequently a fixed sum of money or a multiple of the worker’s pay. However, you will have to pay for any additional coverage you wish to purchase. The usual method of making this payment is payroll deduction. Businesses that employ 100 people or more usually have access to affordable prices. But those in good health may be able to locate a less expensive alternative on the free market.

Life Insurance: Definition, Components, and Types of Policies

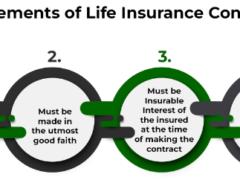

Life insurance: What is it? Life insurance is a contract in which the insurer agrees to pay the assured, or the person for whose benefit the policy is taken, the assured sum of money upon the occurrence of a specified event contingent upon the human life or at the expiration of a certain period, in exchange for a certain premium, either in lump sum or by other periodical payments. An amount of money known as the premium, which can be paid in one lump sum, monthly, quarterly, semi-annually, or annually, is exchanged for an insurance company (referred to as the insurer) agreeing to insure the life of a person (referred to as the insured). Because a specific amount is paid back to the insured at the moment of death or at the end of a predetermined period, life insurance is a form of investment. In order to enforce the contract, the life insurance application needs to accurately describe the insured’s high-risk behaviors and previous and present health problems. The conditions of each contract, which is a formal agreement, define the boundaries of the insured events for life insurance policies. Contractual exclusions often restrict the responsibility of the insurer; examples of these types of claims include those pertaining to fraud, war, riots, suicide, and civil unrest. Essential Components of a Life Insurance Policy 1. All requirements for a legally binding contract must be met by a life insurance policy: Every requirement for a legal contract must be present in the life insurance policy. For a contract to be enforceable, it needs to contain specific components, such as offer and acceptance, free consent, the ability to enter into a contract, legitimate consideration, and lawful object. 2. A life insurance contract is a legally binding agreement signed with the utmost good faith: Life insurance contracts demand the highest degree of good faith from both parties. The insured must be accurate and truthful when providing information to the insurance provider. The norm of uttermost good faith states that in order to appropriately assess the risk, the proposer (insured) and the insurer must have been in agreement at the time of the contract. He is required to give the insurer all pertinent health-related information. They ought to disclose all pertinent information about the risk in an accurate and comprehensive manner. It is his duty to accurately report all material facts that comes to his knowledge, even if the insurer doesn’t ask. 3. The insured must have an insurable interest at the time the contract is made. The insured must be interested in the life being assured in order to be eligible for life insurance. An insurable interest is a financial interest. If there is no insurable interest, the insurance contract is void. The insured must have an insurable interest in the life in order for there to be a valid contract of insurance. In the case of life insurance, the insured party must be insurable at the time the policy is issued. The assured need not, at maturity, also hold an insurable interest. 4. Life insurance is not an indemnity contract; only a predetermined sum of money is paid because human life is not refundable. As a result, the amount payable under a life insurance policy at the time the event occurs is set. As a result, an indemnity contract is replaced by a life insurance contract.

Seven Things to Think About Before Purchasing House Insurance

Purchasing a House Insurance is among the most significant choices you will ever make. Whether you’re shopping for a new provider, a seasoned pro, or a first-time home buyer, you should make sure that your largest investment is sufficiently covered in the event of an emergency. In Canada, home insurance is not required, in contrast to auto insurance. But protecting your house, your possessions, and your finances is crucial. However, understanding insurance coverage can occasionally be challenging, unpleasant, and even overwhelming. What is encompassed? What isn’t it? What quantity do you require? Above all, what constitutes an effective policy? We’ve compiled a list of seven considerations to make sure you obtain the correct coverage before you sign on the dotted line. 1. Pay attention to the House Insurance. There are three parts to core homeowners coverage:Dwellings: This type of insurance protects your home, condo, or apartment against loss or damage. Contents: Protects your personal belongings from theft or loss.Personal Liability: Provides coverage for accidental injuries or property damage to others, including legal, medical, and repair expenses. This is the portion of your policy that kicks in when someone gets hurt on your land or if your neighbor’s house is impacted by a fire or water leak that starts in your house. 2. Beware of House Insurance. It may surprise you to learn that the price of replacing your house is different from the amount you paid for it or even from its current market value. Knowing how they differ from one another can have a significant effect on your monthly premium. Actual Cash Value (ACV), sometimes referred to as the resale or market value, is the amount you would receive for your house after depreciation on the current real estate market. Land, location, and housing demand are additional variables that are taken into account by the ACV but have no bearing on rebuilding. Replacement Value: Also referred to as the blanket value, this is the sum of money needed to replace your house entirely once it has been fully destroyed, without taking depreciation into account. It includes everything, including building permits, building materials, and the cost and availability of competent labor. 3. Pay attention to the weather. The costs of climate change are being felt by homeowners more than ever. Property repairs have skyrocketed in recent years due to record numbers of severe weather occurrences. Among the principal offenders? Hailstorms, wildfires, and strong windstorms. A severe hailstorm that struck Calgary in June 2020 is believed to have caused damages of $1.2 billion. That being said, you shouldn’t rely on your home insurance to save you. Even if you reside in a storm-prone area, standard insurance rarely covers severe weather, natural disasters, and similar “acts of God.” And what could be worse than having a storm destroy your home? having to pay thousands of dollars for restorations that you believed your insurance would cover. 4. Give flood House Insurance some second thought. The worst nightmare of every homeowner is water damage. A tiny leak can cause mold to develop in your walls and insulation, sully your furniture, and seep into your carpets. Even Nevertheless, if they reside in an elevated or low-risk area, the majority of homeowners choose not to get flood insurance. However, just because your house is not in a flood zone doesn’t mean you’re off the hook. Although your house insurance will cover the flooding caused by a burst pipe or water leak, it will not cover overland water that enters your home through windows, doorways, or foundation breaches, or a […]

Homeowners Insurance: What Is It?

A type of property insurance known as homeowners insurance protects your house against theft and damage, as well as other valuables like furniture. Liability coverage against mishaps on the land or within the home is another benefit of having homeowners insurance. The Operation of Homeowners Insurance Four types of occurrences on the insured property are often covered by a homes insurance policy: injury sustained while on the property, loss or damage to personal items, outside damage, and interior damage. A deductible is usually demanded of the homeowner when a claim is filed on any of these situations. 1. The riders that policy carriers offer can lower deductible amounts, cover high-value property, and enhance coverage for particular events. There is an extra price for these adders. Let’s take an example where an insurance company receives a claim for interior water damage to a house. A claims adjuster projects that $10,000 will be needed to restore the property to habitable conditions. The homeowner gets notified of their deductible, say $4,000, in accordance with the terms of the policy agreement if the claim is accepted. In this instance, the insurance provider will reimburse the extra expense of $6,000. The monthly or yearly price for a homes insurance coverage will be less the larger the deductible specified in the insurance contract. Limit of liability The liability limit on your homeowner’s insurance policy establishes the extent of your coverage. Typically, the normal limitations are $100,000, although you are frequently able to select a greater maximum. The liability limit outlines the portion of the coverage amount that, in the event of a claim, would be used to replace or repair any damaged property structures, personal possessions, and living expenses while the property is being repaired. Conventional homeowners insurance policies usually do not cover acts of war or natural disasters like earthquakes or floods. If you reside in a region where these natural catastrophes frequently occur, you might require specialized insurance to protect your property against earthquakes and floods. Home Mortgages and Homeowners Insurance Before the banks will give you money, you typically need to show proof of insurance on the property when you apply for a mortgage. Either the lending bank or you can purchase the property insurance individually. If you choose to get insurance on your own, you can evaluate several quotes and select the one that best suits your requirements. The bank might obtain property insurance for you at an additional expense if you don’t already have one. Generally, payments made toward your home’s insurance coverage are subtracted from your monthly mortgage payment. The part designated for insurance coverage is deposited into an escrow account by the lending bank that receives the payment. This escrow account is used to pay the outstanding balance from the insurance bill when it becomes due. Home Warranty vs. Homeowners Insurance A home warranty is not the same as homeowner’s insurance. A home warranty is a contract that covers maintenance and replacement costs for appliances and systems in the house, including washers, dryers, ovens, and swimming pools. These agreements often have a set expiration date (often 12 months) and are not required to be purchased by a homeowner to be eligible for a mortgage. A home warranty covers defects and difficulties that arise from improper upkeep or normal wear and tear on appliances—circumstances that are not covered by homeowners insurance. Mortgage insurance versus homeowner’s insurance Mortgage insurance is not the same as homeowners insurance coverage. For buyers who put down less than 20% of the purchase price, the bank or mortgage company will usually request mortgage insurance. It is also a requirement of the Federal Home Administration for borrowers of FHA loans. This is an additional cost that may be included in your monthly mortgage payments or paid in full at the time your mortgage is granted. A mortgagee provision is present in certain homeowner policies. If your home is lost or irreversibly damaged while you have a mortgage on it, the provision protects you and pays the lender. The extra risk that a house buyer poses when they don’t fulfill the standard mortgage standards is covered by mortgage insurance for the lender. The mortgage insurance would reimburse the lender if the buyer defaulted on the loan. In essence, even though they both deal with homes, mortgage insurance safeguards the mortgage lender, and homeowners insurance protects the homeowner.

What time of year is ideal to renew your auto insurance?

Since your car is a necessary component of your life, you should always make sure it is insured. The best defense against monetary loss resulting from unintentional damage or even auto theft is having auto insurance. Therefore, you might be wondering when to renew your auto insurance to guarantee that your vehicle will continue to be covered. To maintain continuity in the insurance coverage for your priceless car, we provide some insight into when it is appropriate to renew your policy. When should I get my auto insurance renewed? The policy duration has a start and end date, regardless of whether you purchase auto insurance online or offline. Unless you have chosen a multi-year policy, the policy period is typically one year (3 years). General insurance companies are now permitted to offer multi-year or long-term auto insurance policies for a maximum of three years, according to the Insurance Regulatory and Development Authority of India (IRDAI). This is the time that your auto insurance needs to be renewed. The 3-year auto insurance plan is an option for those who want to keep their coverage from expiring since they don’t renew it every year. It is advisable to renew your vehicle insurance within 15 to 30 days of the expiration date if you have an annual or short-term policy. For instance, it is best to renew your auto insurance starting on March 1, 2022, if it expires on March 31, 2022. If you have neglected to renew the insurance, you can inquire with your insurer about any possible grace periods for doing so. Insurance companies may have different grace periods. However, please be aware that no claims will be honored and your auto insurance coverage is deemed void at this time. Additionally, the premium may go up as a result of a vehicle inspection and the No Claim Bonus (NCB) being reset if there is a significant lapse in time between the expiration and renewal dates. Therefore, to ensure that your automobile is always covered, renew your motor insurance online before the renewal date. When your auto insurance policy ends, what are your options? When the policy’s duration is up, an auto insurance policy expires. You have the following choices if the expiration date of your auto insurance coverage is drawing near. Renew with your current provider. To renew the plan, move to a new insurance provider. And, personalize it to meet your needs (by adding extras, buying a multi-year plan, etc.). When your auto insurance policy ends, what happens? Your financial protection against third-party liability, vehicle damage, and even theft is gone if your auto insurance policy expires. The following are some drawbacks of not renewing your auto insurance. The policy is rendered void. Claims about the coverage will not be accepted by the insurer. You could forfeit the accrued No Claim Bonus (NCB) if you don’t renew the plan within the allotted term. financial losses should your car sustain unintentional damage. fine for using a vehicle without current insurance. The insurance premium may go up if there is a big difference between the expiration date and the renewal date. Additionally, before granting insurance coverage, the insurer could wish to inspect the car. Self-reflection questions to consider while renewing your […]

MOTOR INSURANCE

We provide the three kinds of motor insurance coverage listed below: Third Party: Provides coverage for property damage and bodily injury to third parties resulting from auto accidents. This includes unrestricted culpability for the death or bodily harm of third parties. According to the Motor Insurance Act, this is the minimal coverage needed for any kind of vehicle. There is no cash of any kind given to the policyholder’s car. An outsider Fire & Theft: Coverage includes coverage for property damage, theft, fire, and bodily injury to third parties. For automobiles that are not exposed on the road, this cover is advised. Comprehensive: Incorporates coverage for property damage to the insured vehicle, third-party liability, fire, theft, and accidental damage. It is the broadest cover that is offered. Motor Insurance Classes Covered Classes covers under our Motor Insurance covers: 2. Private Cars 3. Motor cycle / 3-wheelers 4. Commercial Vehicles 5. Passenger Carrying ( Taxi, Tour, Daladala, etc.) 6. […]